Intervention in Alcoholic Drinks Market

Since 2015, the market value of alcoholic beverages in the UK has increased. The market value of alcoholic beverages reached around € 65 billion in 2019 (Statista, 2019). The alcoholic beverage market brings economic benefits but also causes many problems. The number of alcohol-related deaths has increased since 1954. There were 7,697 deaths specific to alcohol in the UK in 2017 (about 12.2 per 100,000 people). This has been the highest level since 2008 (Office for National Statistics 2019). In addition, alcoholic beverages are also associated with drunk driving and other crimes. Therefore, government intervention has become chiefly vital. This piece will illustrate the economic impact on alcohol market using two main types of government interventions, setting price floor and adding taxes on alcohol price.

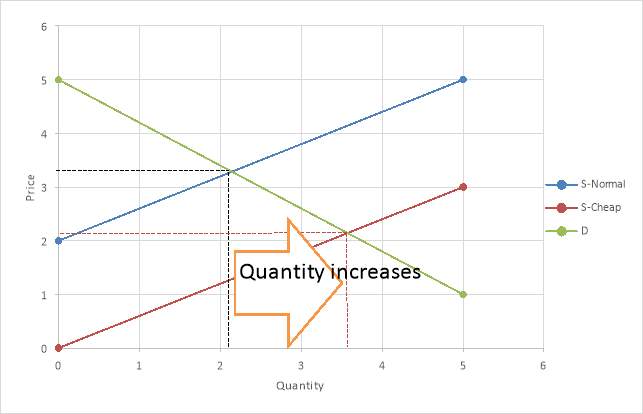

The alcoholic beverage industry requires government intervention as the producers rely significantly on excessive consumers to boost their profits (Consultancy Organization, 2018). The first issue is the case of cheap alcohol that companies are producing to satisfy major addicts. Low-income earners rely on cheap alcoholic drinks to fulfill their urge for alcoholic drinks with their limited income. Alcohol is now 54% more available than it was 30 years ago, though stores and shops are struggling to attract customers with ridiculously low prices and deals (Alcohol-focus-scotland.org.uk, 2019). The cheaper and easier a commodity is, the more it is used, and here we can see the cheap alcoholic drinks will cause demand to increase.

Those cheap alcoholic drinks not only attract low-income people to buy, but also attract teenagers because they can afford them with their own money. Earlier this year, a 16-year-old girl tragically died after drinking some cheap alcoholic drinks at a party (Alcohol-focus-scotland.org.uk, 2019).

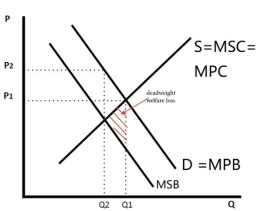

Alcohol externalities can result in market failure and social inefficiency. This provides a justification for intervention by the government. There are risks to the rest of society because you drink liquor–drunkenness, lost productivity, insurance expenses, NHS costs. You may have some personal benefits from drinking, but the social benefit with these costs is less than your private benefit. You've got a good time, but on a Monday morning the business is failing out of your lower productivity. The outcome in a free market would be Q1. At Q1 – SMC>SMB. If there is a price floor of P2, it would reduce demand to Q2 where SMB = SMC and the outcome is socially efficient.

Therefore, the government should intervene the market of cheap alcoholic drinks. The intervention policy to be briefly described is to set a price floor. It will make individuals pay a price closer to the social marginal cost -closer to social efficient level and it will reduce overconsumption of alcohol.

Therefore, the government should intervene the market of cheap alcoholic drinks. The intervention policy to be briefly described is to set a price floor. It will make individuals pay a price closer to the social marginal cost -closer to social efficient level and it will reduce overconsumption of alcohol.

We can see here, Sheffield University's research shows that if alcohol is priced at 45p per unit consumption decreases by 4.3 percent – a 75 percent higher effect than 40p. (Pettinger, 2019). Furthermore, by setting a price floor, the biggest effect is among young' binge' drinkers who are most sensitive to price, it may discourage them from excessive drinking. It could also reduce the demand for police services and health care. And in the same time, alcoholic beverages of' high quality' are generally expensive, which can decrease the drinking frequency.

Moreover, the market will react to the policies of the government enforces them. The price floor will influence the free market which advocates favors competition and pricing is a tool firms use to be competitive (Whitehead, 2019). There will be fewer price wars and promotions in the alcoholic beverage market. That will fall the demand for alcoholic drinks, thus limiting growth in the market. In the same time firms would have to rely on other parameters other than pricing for competitive ability (Economics Online, 2019). There will be fewer price wars and promotions in the alcoholic beverage market, the company will focus their competition on quality.

Secondly, adding taxes is the word that comes to mind most easily when talk to government intervention, because it is a common behavior in many countries. For example, you buy a pint of 5.0% strength lager in the UK. The Beer Duty you pay is 19.08p x 5.0 = 95.40  pence per liter. This works out at just over 54 pence a pint (about 568ml or 0.568 liters).

pence per liter. This works out at just over 54 pence a pint (about 568ml or 0.568 liters).

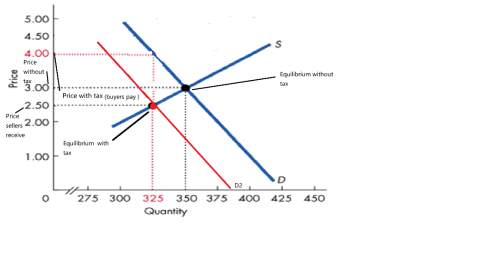

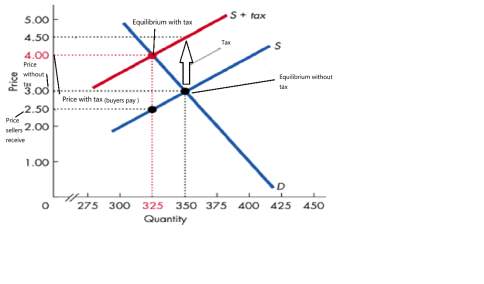

Tax incident is the study of who bears the burden of a tax. Taxes can change the market equilibrium, no matter who the government levy taxes, taxes always make buyers pay more and sellers get less. To different pairs of symbolic taxes will cause different curve changes, taxing buyers, will cause the demand curve to move down. Correspondingly, taxing the seller will cause the supply curve to shift to the left. The two different graph of two different curve changes are shown below, and the conclusion is surprising: the taxation of the buyer and the taxation of the seller are the same. In both cases, the “wedge” of the tax moves the supply and demand curves relatively. In the new equilibrium, the buyer and the seller share the tax burden. The only difference between taxing buyers and sellers is who gives the money to the government. But the tax burden remains the same. So for the macroeconomic impact, taxation inhibits market activity. In the case of the alcohol market, when an alcoholic beverage is taxed, the sales of the beverage at the new equilibrium are reduced. The buyer and the seller share the tax burden. In the new equilibrium, the buyer pays more for the alcoholic beverage, and the seller actually gets less. Therefore, the government can reduce the number of people who consume alcoholic beverages by taxation and reduce the profitability of suppliers who profit from the alcohol market to achieve the effect of suppressing alcohol market activities.

In addition, elasticity is also an important indicator of who bears the tax. Alcoholic beverages are commodities that are flexible in demand and supply inelasticity, and sellers bear more taxes. Because for most alcoholics and adolescents, alcohol is a very flexible consumer product, and supply elasticity is less than demand elasticity. This is understood as the willingness of the buyer or seller to leave the market when the elastic measurement conditions are unfavorable. When taxing, choosing the small party (small elasticity) can't easily leave the market, so it has to bear more taxes. The tax burden tends to fall on the inflexible side, which is here on the producers of alcoholic beverages.

A one-off 1% increase in all alcohol taxes would reduce annual alcohol-related deaths in England by 35 (0.3%) and alcohol-related hospital admissions by 1,624 (0.2%)(Cancerresearchuk.org, 2019). With the price increase, there is a relative decline in alcohol consumption. The government should therefore add taxes on alcoholic beverages to discourage their market supply which will make consumers find it expensive, thus reducing the intake for their needs. As the intake for the alcoholic drinks decreases, the supply of alcoholic beverages will be reduced on the market. The government will therefore have gained economically through the levies on the alcoholic drinks sold while reducing consumer volume. Through tax, reimbursement by the state to both community and social health that it may attach protection to reduce crime or that it can improve public transport.

Government intervention brings both advantages and disadvantages. The price floor and taxes will have a big impact on low-income people. Because drinking cheap liquor is intrinsic in ardent drinkers, ceasing from its uptake is difficult. Consumers who cannot afford the high prices will have to resort to black-market or make alcoholic drinks by themselves. These actions are very dangerous, and most importantly, it's illegal. And the increase in taxes on alcohol has clearly had an impact on the alcohol industry and retail stores. The company must change their policies to make a profit. The company may be will reduce employment. Unemployment will rise, and the impact on the government will take its toll on the unemployed. There will be more burdens to solve all the problems.

In summary, setting a price floor and adding taxes can lead to significant reductions in alcohol consumption. And increase government revenue, that would allow the government to spend more money on things like health care and improve economic. At the same time, the rising price of the alcoholic drinks can reduce the effects of most associated with alcoholism, including disease, crime related to alcohol. On the other hand, increase the alcohol taxes may be harmful to all kinds of alcoholic industry, and increase the number of unemployed. The government should consider the advantages and disadvantages and let people benefit from it.

References

- Statista. (2019). Alcoholic drinks: market value in the UK 2015-2020 | Statista. [online] Available at: https://www.statista.com/statistics/491080/alcoholic-drinks-united-kingdom-uk-market-value/ [Accessed 22 Nov. 2019].

- Ons.gov.uk. (2019). Alcohol-specific deaths in the UK - Office for National Statistics. [online] Available at: https://www.ons.gov.uk/peoplepopulationandcommunity/healthandsocialcare/causesofdeath/bulletins/alcoholrelateddeathsintheunitedkingdom/registeredin2017 [Accessed 22 Nov. 2019].

- Consultancy Organization (2018). Excessive drinkers boost the UK alcohol industry by £13 billion. [online] Consultancy.uk. Available at: https://www.consultancy.uk/news/18456/excessive-drinkers-boost-uk-alcohol-industry-by-13-billion [Accessed 20 Nov. 2019].

- Alcohol-focus-scotland.org.uk. (2019). Cheap alcohol is costing Scotland dear. [online] Available at: https://www.alcohol-focus-scotland.org.uk/news/cheap-alcohol-is-costing-scotland-dear/ [Accessed 23 Nov. 2019].

- Alcohol-focus-scotland.org.uk. (2019). Cheap alcohol is costing Scotland dear. [online] Available at: https://www.alcohol-focus-scotland.org.uk/news/cheap-alcohol-is-costing-scotland-dear/ [Accessed 23 Nov. 2019].

- Pettinger, T. (2019). Minimum price for alcohol – pros and cons - Economics Help. [online] Economicshelp.org. Available at: https://www.economicshelp.org/blog/7130/economics/minimum-price-for-alcohol-pros-and-cons/ [Accessed 23 Nov. 2019].

- Whitehead, T. (2019). Ban on the sale of cheap alcohol. [online] Telegraph.co.uk. Available at: https://www.telegraph.co.uk/news/uknews/law-and-order/8264834/Ban-on-the-sale-of-cheap-alcohol.html [Accessed 20 Nov. 2019].

- Economics Online (2019). New Classical Theory - development economics | Economics Online. [online] Economicsonline.co.uk. Available at: https://www.economicsonline.co.uk/Global_economics/New_classical_theory.html [Accessed 20 Nov. 2019].

- Cancerresearchuk.org. (2019). [online] Available at: https://www.cancerresearchuk.org/sites/default/files/alcohol_and_cancer_trends_report_cruk.pdf [Accessed 24 Nov. 2019].

Cite This Work

To export a reference to this article please select a referencing style below: